Employee Loans

The Employee Loan Module automates the deduction process and tracking of loan balances, whether the loan is internal or from a third party. These deductions are seamlessly integrated into the Payroll Entries, ensuring that loan information is accurately reflected in the corresponding accounting records.

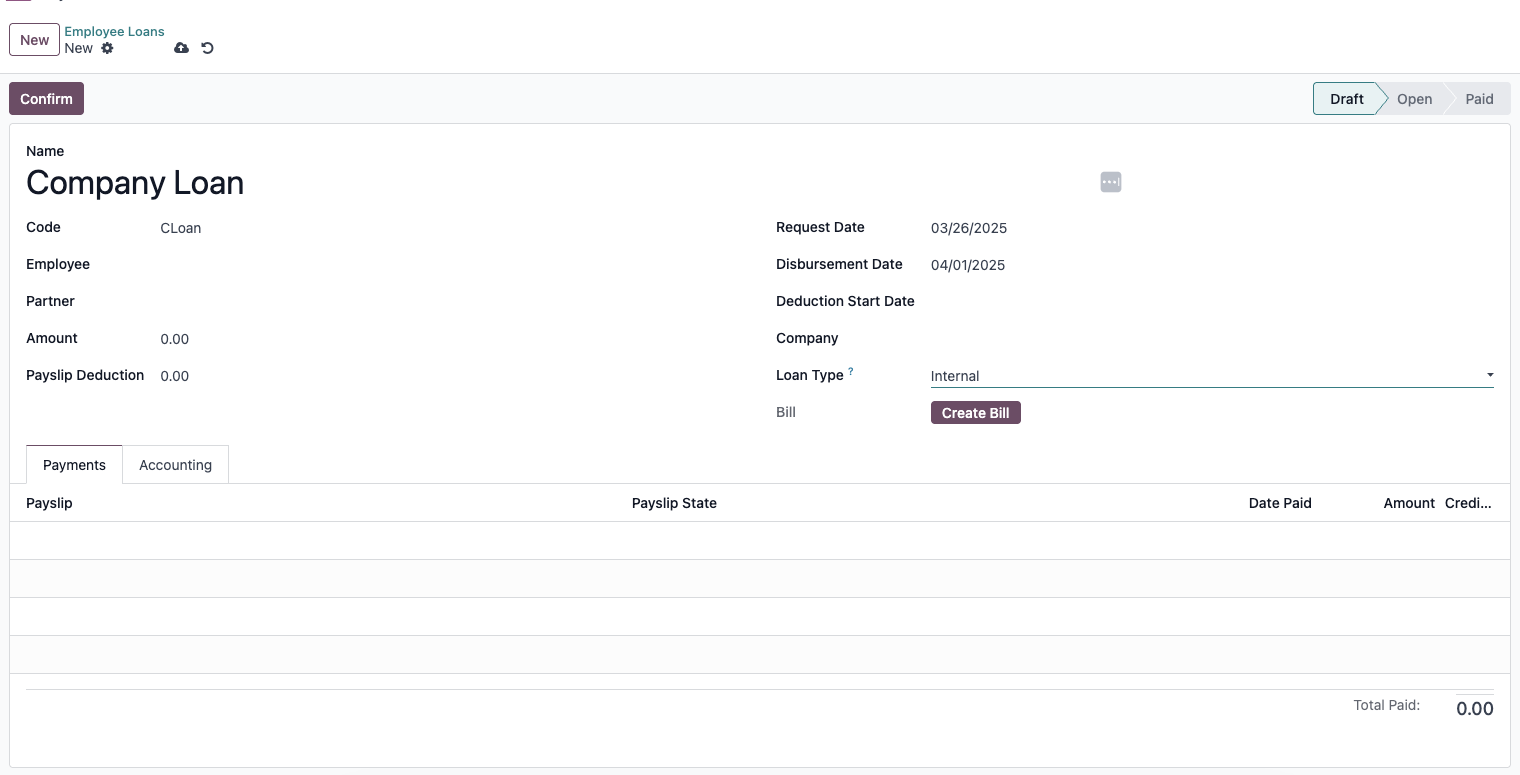

How to Create a Loan Record

In the Payroll app > go to Contrcts > Loans > click the  button.

button.

- Name: A free-text field where the loan name or description can be entered.

- Code: A free-text field; ensure the same code is used consistently in the salary rule configuration.

- Employee: Select the employee from the dropdown, which is populated from the Employee Module list.

- Partner: If it is a third-party loan, enter the name of the provider (e.g., bank or government agency). For an internal (company) loan, set the employee as the partner.

- Amount: The total amount payable, irrespective of the breakdown between principal and interest.

- Payslip Deduction: The amount to be deducted per payroll period for the loan repayment.

- Request Date: The date the loan was requested by the employee.

- Disbursement Date: The date the loan proceeds were disbursed to the employee.

- Deduction Start Date: The date when loan repayment will begin.

- Loan Type: Select between Internal or Third-party to define the loan source.

- Create Bill: Click this button to generate a Vendor Bill for internal loans. This allows processing loan proceeds disbursements directly from the Vendor Bill.

Note: Ensure that a corresponding salary rule is created to automate the deduction process for the loan repayment.

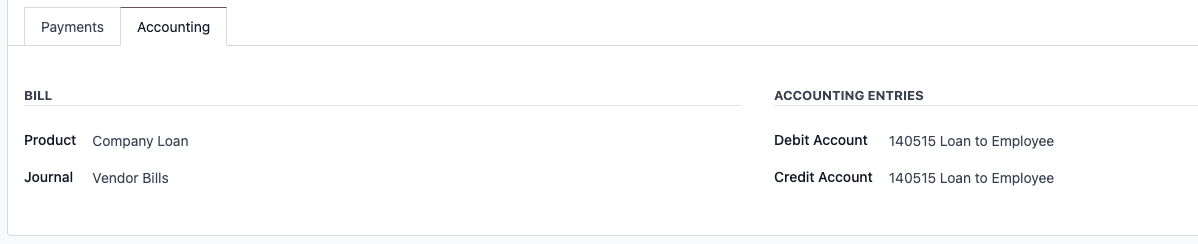

Accounting

Bill

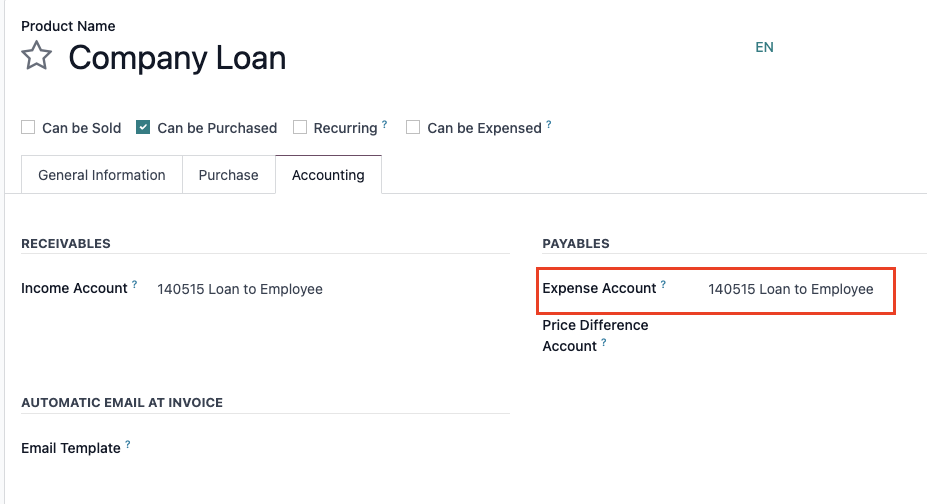

- Product: For internal company loans, a Product is required to generate the Vendor Bill for the disbursement of loan proceeds.

- Note: The expense account assigned to the product must be an Asset account, as it represents the amount associated with the loan.

- Journal: Typically, the journal used for internal company loans is the Vendor Bills journal. This journal captures the financial entries related to the loan disbursement and subsequent tracking.

Accounting Entries

- Debit and Credit Account: Select the appropriate accounts to be affected by the loan payment salary deduction.

- For internal company loans, this should be the Asset account used when creating the Vendor Bill.

- For third-party loans, this should be a Liability account representing the remittable amount collected on their behalf.

Once all fields are completed, click Confirm to save the loan configuration.

With the correct setup, the loan deduction will be automatically included in the payslips. The loan will be marked as "Paid" once the total payments match the loan amount.